- Making Sense of Your Money

- Posts

- The $400K Side Hustle Advantage

The $400K Side Hustle Advantage

How executives are quietly shielding income and doubling retirement contributions through savvy entity moves and layered deferral strategies.

☕ Good morning!

At $500K+ W-2 income, normal rules stop applying. It seems like you’re fighting less for gains but more to survive tax-wise.

High earners who thrive grind harder, but also learn to play the system smarter. They build infrastructure, weaponize volatility, and steer every dollar with precision.

Today, we’re breaking down two elite moves and why most top earners are still burning cash without realizing it.

Let’s get tactical.

🦾 Entity Engineering: Build Your Tax Machine

W-2 income is the worst type of income for taxes: maxed out on FICA, boxed out of deductions, zero structural flexibility. The top W-2 brackets attract tax hits like no other.

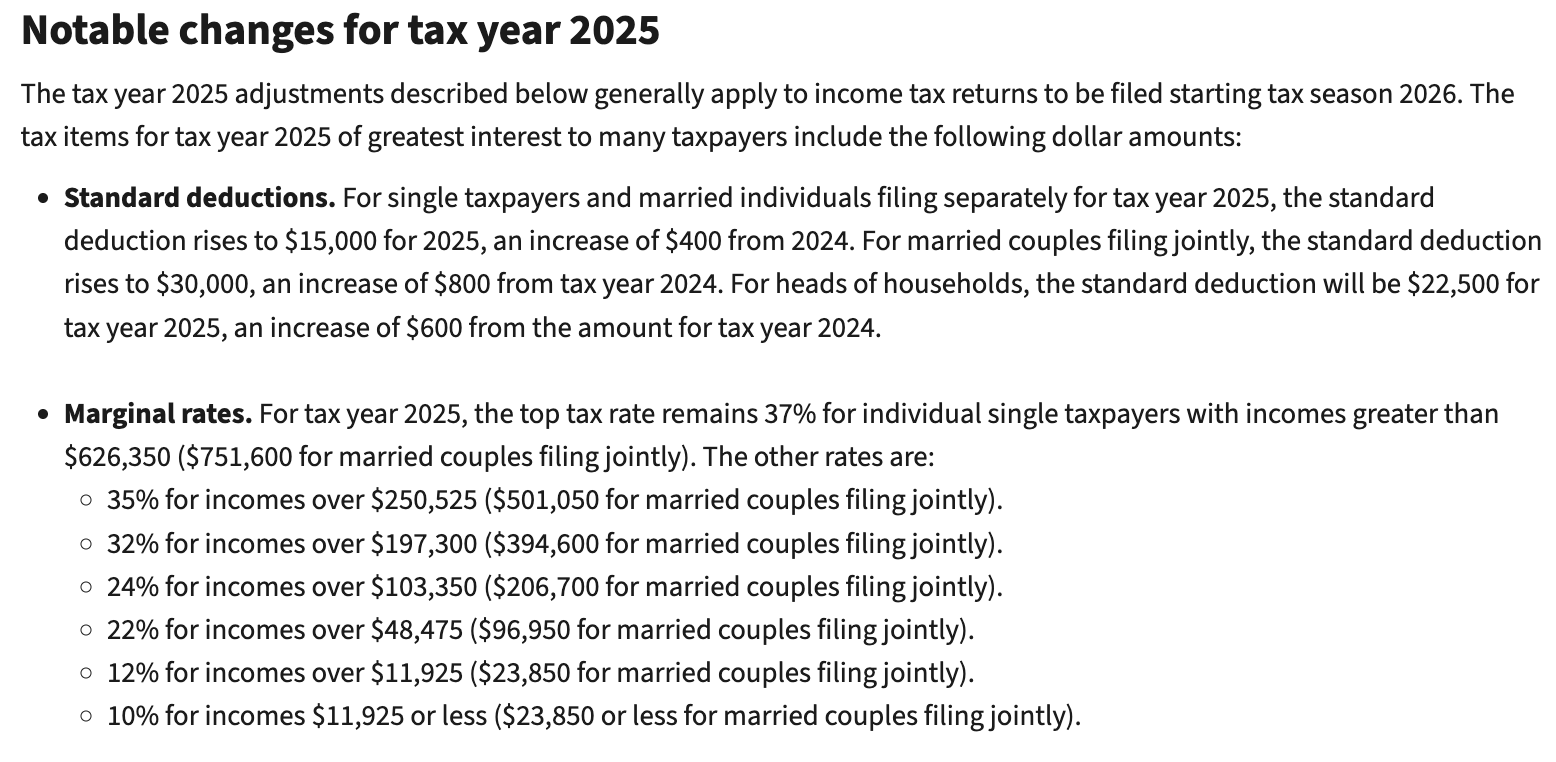

The W2 tax brackets in 2025. (Source: IRS)

Wall Street execs have had something like this in place for decades– by creating a separate business entity (like an S-Corp), you can gain some control over how and when certain types of income is received.

Let’s be dead clear:

An LLC by itself does not lower your W-2 income or taxes.

✅ A side business set up as an LLC (and taxed correctly) can lower the taxes on the side business income.

❌ It does NOT touch your actual W-2 salary from your employer. That W-2 is locked in — taxed hard, FICA and all.

That said, it lets you optimize all the new income you control outside your job.

When you earn business income directly (like through a sole proprietorship or Schedule C), you pay full self-employment (SE) tax on everything, about 15.3% on your net profit.

An S-Corp lets you split income between salary and distributions, paying self-employment tax only on the salary portion, and skipping it on the distributions.

For example, if you earn $250K through an S-Corp and structure it right, you can save ~$19,000–$25,000 per year just on SE taxes, without doing anything sketchy, because of the distribution split.

That’s just part of the magic. The unlock isn’t automatic from just “having an LLC.”

It comes because business income (through an entity) lets you legitimately deduct expenses ordinary W-2 employees can’t.

An LLC or S-Corp can create a layer of legal separation between personal and business assets, but you still have to document and substantiate everything.

The first steps

Start with a personal LLC taxed as an S-Corp. Set your own "reasonable salary" and list all qualified business deductions.

Then you can get creative. For example, you could layer in an IP-holding company to own trademarks, digital products, or consulting materials, and license them back to your S-Corp.

Need more stealth? Create a Family Management Company billed for admin services. This legally shifts more income into deductible lanes, and sets the foundation for future (bigger) family office structures.

I share those last two points not as a blanket prescription for anyone reading this, as each financial situation is different, but rather to get the creativity wheels spinning.

Check out my recent YouTube Short on how high earners utilize the side hustle tax strategy…

🔥 Retirement Shelter XXL: Stack Deferrals the Right Way

Maxing out your W-2 401(k) should be a rounding error in the long run. Elite players layer a second income source to blow the deferral game wide open.

For example, you could set up an independent contractor gig under your S-Corp or LLC. Then:

Open a Defined Benefit Plan—$250K+/yr deferral potential (if income supports it).

Add a Solo 401(k)—another $66K shelter.

Explore 457(b) Deferred Comp Plans if your employer offers one. or simulate them through executive carveouts.

The real finesse? Smash increased contributions during monster income years, and throttle back when earnings dip.

Timing matters. These shelters are heavy armor, but if you’re careless, they become lead weights.

Watch out: Defined Benefit Plans are like handcuffs. Once you open them, the IRS expects certain minimums, no excuses.

Most players are stuck at "I think I maxed my 401(k)."

Meanwhile, you're stacking $400K+ a year tax-deferred, quietly building a war chest.

W2 Side Hustle in Practice

Now meet Alina, a CFO with a bloated W-2 and rising income from coaching and author royalties.

Prior to the strategy, she ran it all through a Schedule C, which was messy, exposed, and overtaxed. After structuring, she:

Qualified for the 20% IRC §199A deduction on pass-through income

Pulled rent deductions with a corporate leaseback of her home office

Pushed $220K+ annually into retirement across Solo 401(k) and defined-benefit setups

She didn’t stop at one entity. She spun off a second LLC to license her IP separately, building a firewall between her advisory services and her royalties.

One set of income gets retirement benefits. Another gets shielded as passive royalty flow.

Same human, two legal tax profiles.

🎯 Making Sense of Your W2 Side Hustle Strategy

This is the meta-game.

The point isn’t just to save on taxes, but to strategically set your moves multiple years out, making sure your money flows intelligently, before the IRS even takes its cut.

By engineering your income, smashing down the tax drag, and keeping optionality alive even when chaos hits, you’ll surprise yourself with how much wealth you can protect. At this level, end-of-year defense alone won’t cut it. Strategic infrastructure wins.

Stay savvy, stay proactive, and keep your financial future bright.

Until next week!

💡 Explore Our New Website – Your Hub for Financial Clarity -We’ve launched a brand-new website designed to help you make smarter financial decisions with ease. Explore our weekly blogs, expert videos, and in-depth whitepapers & guides—all tailored to help you optimize your wealth and stay ahead.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Security and Advisory Services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC The information contained in this e-mail message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.